Table 87 Coal Oven Pizza

DEAL

EPISODE SUMMARY

🕓 Air Date: October 16, 2015

Asking For:

$200,000 for 10%

Investor:

Lori Greiner

Deal:

$200,000 for 18.5%

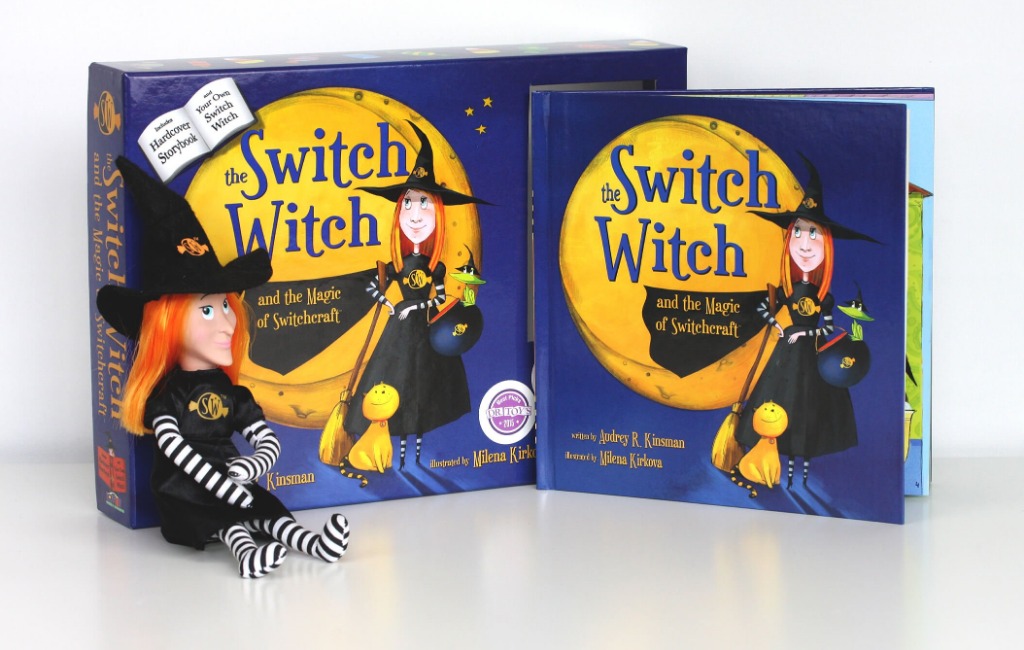

PRODUCT SUMMARY

Table 87 offers high-quality, coal-oven pizza, with a unique thin crust, available as frozen slices or pies for both retail and on-demand consumption.

WATCH HERE

IN A RUSH?

Click these to jump to the section you want to read.

Background Story

Thomas Cucco, a Brooklyn native and pizza enthusiast, opened his first shop on Atlantic Avenue in 2012. As the popularity of his pizza grew, he expanded to a second location and envisioned making his pizza accessible to people everywhere. Wanting to secure an investment to purchase equipment and streamline operations, Thomas entered the Shark Tank with the hope of passing his pizza legacy on to future generations.

The Product

Table 87 Frozen Coal Oven Pizza uses only the finest ingredients, including fresh mozzarella, Fontina cheese, Alta Cucina tomatoes, Reggiano Parmesan, and olive oil. The pizzas are cooked in a 900-degree coal-fired oven, where they flash-cook in under two minutes.

The unique selling point is the ability to buy frozen, coal-oven pizza by the slice or pie, a rarity in the market. The frozen slices, available in supermarkets like Whole Foods Market and Fairway Market, are priced at $3 with a suggested retail of $4.99, while whole pies sell for $6.50 with a suggested retail of $9.99.

How It Went

The company’s position before Shark Tank

Table 87 started its frozen pizza business nine months ago, achieving $260,000 in total sales. The company has secured placements in 250 supermarkets, including well-known chains like Whole Foods Market and Fairway Market. Thomas emphasizes the potential to expand to 5,000-10,000 bars in New York City, presenting a significant growth opportunity. Currently, the pizzas are made in Table 87’s brick-and-mortar locations, and the $200,000 sought in the pitch is intended for purchasing additional ovens to scale the frozen pizza production. Thomas envisions separating the frozen business as its own entity to streamline operations.

The Negotiations:

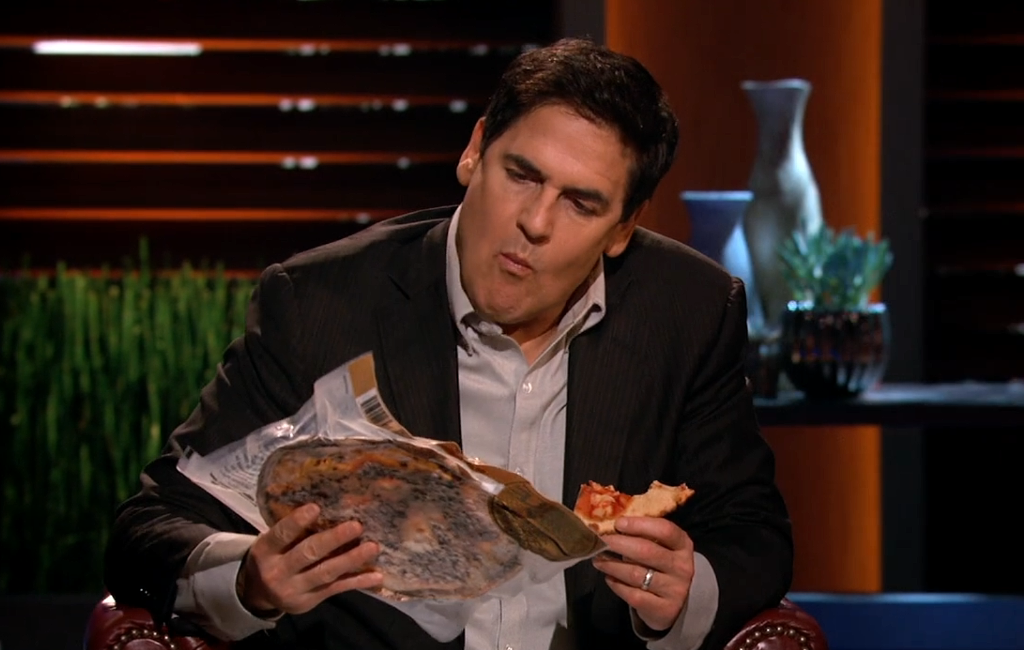

The negotiation process involved Thomas seeking a $200,000 investment for 10% equity. Barbara Corcoran offered $200,000 for 30%. Barbara’s offer represented a significant equity stake. Mark and Robert opted out, with Mark expressing concerns about the competitive frozen pizza market. Kevin’s offer involved a royalty deal, where he wouldn’t take equity but would receive a portion of the sales for each slice sold until a set amount was repaid.

Lori Greiner made a counteroffer of $250,000 for 20%. After some back-and-forth, they settled on a deal at $250,000 for 18.5%, with Lori Greiner becoming a partner in Table 87 Frozen Coal Oven Pizza. Thomas ultimately chose Lori’s offer, emphasizing her enthusiasm, additional funding, and potential market connections as key factors in his decision. The negotiation highlighted the challenges of valuing a business in a competitive industry and the importance of aligning with a shark who brings strategic value beyond just financial investment.