RewardStock Travel Points Manager – Now Part of Experian

DEAL

EPISODE SUMMARY

🕓 Air Date: November 18, 2018

Asking For:

$200,000 for 10%

Investor:

Mark Cuban

Deal:

$320,000 for 10% + 1% advisory shares

PRODUCT SUMMARY

RewardStock is an automated reward travel advisor and booking service that optimizes the use of travel reward points for users, making it easy to get the most value from their points.

WATCH HERE

IN A RUSH?

Click these to jump to the section you want to read.

Background Story

Jon Hayes, hailing from Raleigh, North Carolina, and a graduate of Princeton University, brings a wealth of experience in mergers and acquisitions advisory from his seven-year tenure in Manhattan. The genesis of RewardStock sprouted from an extraordinary personal experience during Jon’s honeymoon. He and his wife enjoyed an opulent trip to the Maldives, flying first class and staying in a $1,000-a-night over-the-water villa, all for a mere $200 in cash.

This remarkable journey ignited Jon’s realization that the complexities of leveraging travel rewards, often a daunting task for many, could be streamlined. Opting for a career shift, Jon departed from his role on Wall Street to embark on a new venture. Armed with a vision to simplify the intricate world of travel rewards, he delved into self-education, teaching himself coding to develop the prototype for RewardStock.

The company’s headquarters is situated in Raleigh, reflecting Jon’s roots and commitment to his local community. His decision to create RewardStock was born not only from personal travel success but also from the recognition that many individuals struggle with the intricacies of maximizing travel rewards. With a desire to democratize the benefits of reward programs, Jon set out to create a platform that would empower users to effortlessly navigate the complexities of reward systems and unlock incredible travel experiences. This dedication to making travel rewards accessible and enjoyable forms the core of both Jon’s personal journey and the mission of RewardStock.

The Product

RewardStock is an innovative platform designed to revolutionize the way individuals navigate and benefit from travel reward programs. The product operates as an automated reward travel advisor and booking service, streamlining the process of maximizing travel points for users.

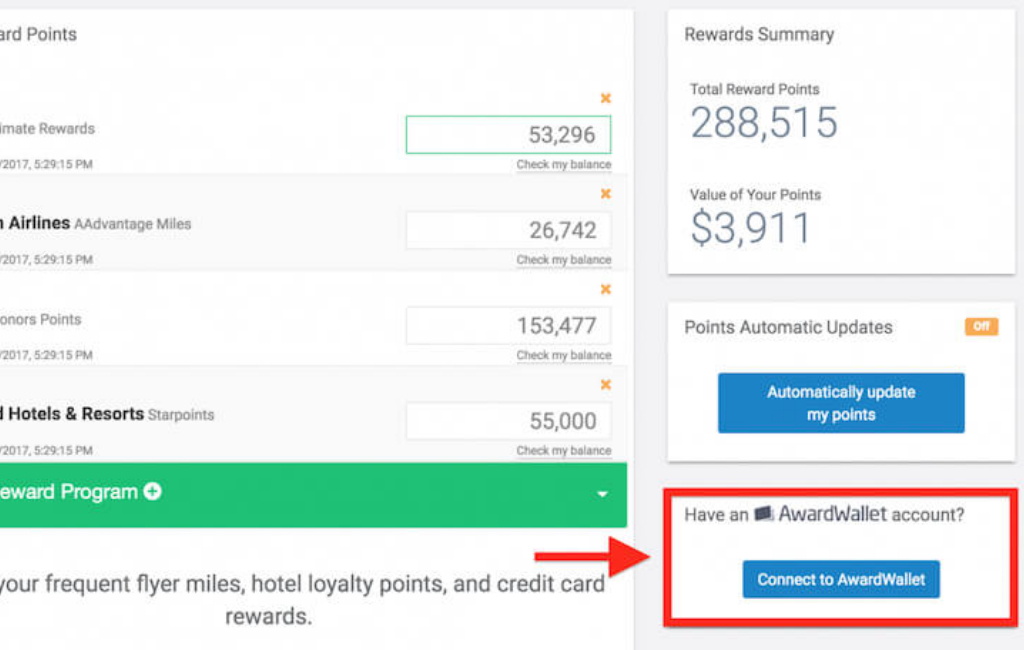

To use RewardStock, customers create profiles on the platform, inputting their existing reward points from various sources such as credit cards and airlines. The system then meticulously analyzes this data to offer strategic recommendations on the most efficient ways to utilize points for optimal travel benefits. Users can easily search for their desired destinations, and RewardStock presents personalized options based on specified criteria, making the entire process user-friendly and accessible.

The platform not only curates existing points but also handles the execution of complex transactions on behalf of users. This eliminates the need for users to navigate the intricacies of point conversion and redemption, ensuring a hassle-free experience.

RewardStock operates on a subscription model, charging users a reasonable $29 annual membership fee. In addition to this, the platform earns referral revenue by connecting users with products that facilitate quicker point accumulation. This dual revenue stream ensures sustainability for the platform while offering users an affordable and efficient solution to make the most out of their travel rewards.

How It Went

The company’s position before Shark Tank

RewardStock, launched two years ago, has shown promising early signs despite modest revenue figures. With a user base of 10,000 individuals, the company has achieved $50,000 in sales during its testing phase. The revenue model revolves around a $29 annual membership fee, providing users access to the platform’s automated reward travel advisory and booking services. Additionally, the company earns referral revenue by connecting users to products that enhance their ability to accumulate points efficiently. While the revenue is relatively small at this stage, the company’s valuation stands at $4 million, demonstrating the potential perceived by investors.

The valuation is based on a $3.5 million valuation cap on a convertible note, with the company having raised a total of $700,000 in capital. Jon Hayes, the founder, has personally invested $20,000 in the venture. RewardStock is currently structured as a four-person team, with Jon Hayes at the helm. A notable bottleneck in the company’s operations is the limited availability of programming resources, with only one full-time programmer in addition to Jon. This constraint highlights an area that the company intends to address with the infusion of capital.

The company’s health and position are characterized by its ability to attract users and generate revenue, albeit on a smaller scale. Partnerships with various credit card companies and airlines could potentially contribute to the platform’s growth as it expands its user base. The $700,000 in funding has been crucial for RewardStock’s development, but the limited capital, as indicated by the relatively small sales figures, suggests a need for additional resources to scale the platform effectively. Mark Cuban’s recent investment of $320,000 for 10% equity and 1% advisory share is poised to provide the necessary boost. This infusion of capital will likely be directed towards expanding technical resources, a key area of concern for the company.

The Negotiations:

The negotiations for RewardStock on “Shark Tank” unfolded as Jon Hayes sought a $200,000 investment for a 5% equity stake in his travel rewards optimization platform. Mark Cuban emerged as a keenly interested investor, recognizing synergy with his existing platform, Honeyfund. Cuban proposed a more substantial offer of $320,000 for a 10% equity share along with a 1% advisory share, emphasizing the added value he could bring to the venture.

Kevin, Daymond, Barbara, and Lori expressed reservations, citing concerns about the company’s early stage, low revenue, and its need for significant additional investment. Despite their skepticism, the negotiations showcased Jon’s commitment to his product and his ability to secure a deal. Barbara and Lori bowed out early, stating that the investment at this stage made them uncomfortable. Kevin and Daymond expressed interest but at higher equity percentages. Mark Cuban, however, stood out with his strategic offer, citing the value he could contribute to the company’s growth.

In a pivotal moment, Jon accepted Mark Cuban’s offer, securing $320,000 in funding. This deal not only provided the necessary capital for RewardStock’s expansion but also brought Cuban’s expertise and influence into the fold. The negotiations revealed the challenges faced by the company, including a bottleneck in programming resources, but Mark Cuban’s investment signaled a turning point for RewardStock, positioning it for accelerated growth and success in the competitive travel rewards optimization market.