Changed – Student Loan App

DEAL

EPISODE SUMMARY

🕓 Air Date: January 28, 2018

Asking For:

$250,000 for 15%

Investor:

Mark Cuban

Deal:

$250,000 for 25%

PRODUCT SUMMARY

Changed is an app that helps users pay off their student loans by rounding up everyday purchases to the nearest dollar and applying the spare change towards their student loan debt.

WATCH HERE

IN A RUSH?

Click these to jump to the section you want to read.

Background Story

Changed, founded by brothers Dan and Nick, originated from their personal experiences growing up in Chicago. Raised by a single immigrant mother who worked multiple jobs to provide for them, they faced the challenges of student loans while pursuing higher education. The idea for Changed emerged as they recognized the growing issue of student loan debt in the United States, which currently exceeds $1.3 trillion.

With a desire to alleviate the financial burden on college graduates, they developed Changed to revolutionize the way Americans approach and tackle student loan debt. The brothers bring a personal touch to the business, understanding the emotional attachment people have to their student loans and the impact it has on their lives.

The Product

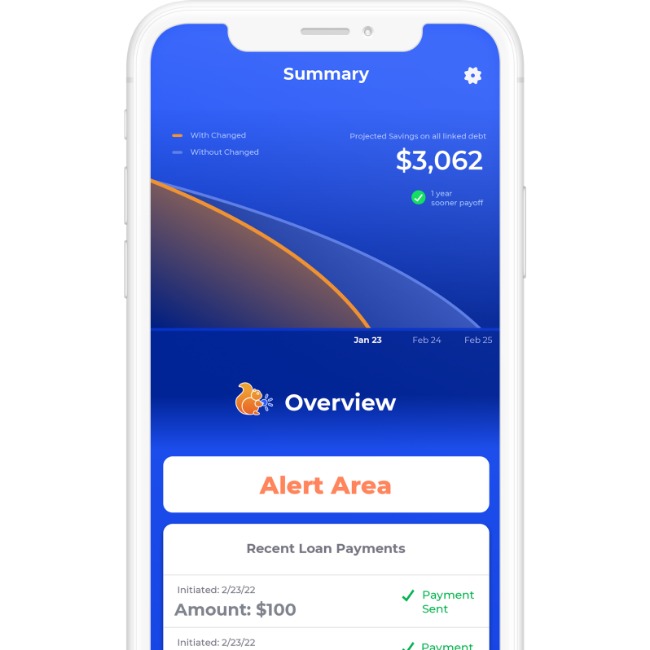

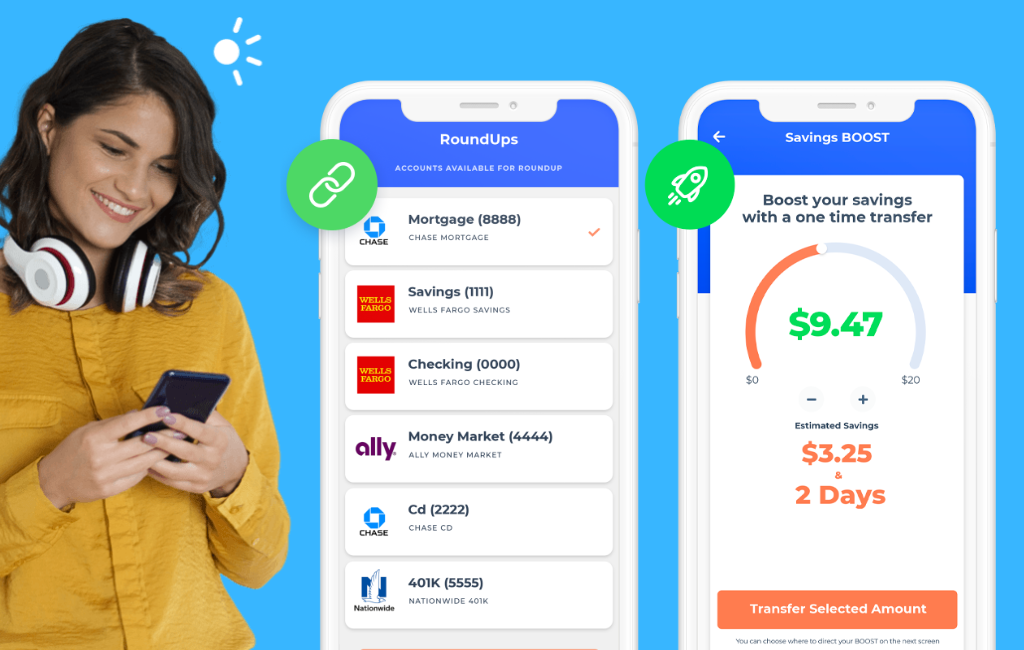

Changed is a user-friendly app that addresses the student-loan debt crisis by leveraging spare change from everyday purchases. Users link their bank accounts to the app, which then rounds up each purchase to the nearest dollar.

For example, if a user buys a $3.45 cup of coffee, Changed rounds it up to $4, saving 55 cents toward their student loan. The accumulated round-ups are stored in a personal FDIC-insured Changed account.

Once the balance reaches $100, the app automates a payment toward the user’s student loan. Each user has a personalized dashboard to track their daily round-ups, Changed balance, and payments made toward their student loan. The app also provides insights into the time and money saved with each payment, motivating users to stay engaged in the process.

How It Went

The company’s position before Shark Tank

Since its launch in March, Changed has gained over 9,000 downloads and nearly 1,000 active FDIC-insured accounts. Impressively, the company has already facilitated $20,000 in student loan payments, showcasing its early impact. The founders aim to reach $100,000 in student loan payments by the end of the year.

The company started with a modest $50,000 from friends and family and has been primarily bootstrapped, with one founder working in sales and the other driving for Uber to support the venture. Currently, Changed charges a $1 monthly member fee, and while the user base is just under 1,000, the founders are optimistic about the app’s potential for growth.

The Negotiations:

The negotiation process on Shark Tank involved the founders, Dan and Nick, seeking $250,000 for 15% of their company. Barbara Corcoran and Alex Rodriguez both opted out, expressing concerns about the competitive landscape and potential challenges in convincing banks to participate. Mark Cuban made an offer of $250,000 for a larger equity stake of 25%, emphasizing his belief in the company’s potential.

Lori Greiner appreciated the mission but declined due to a perceived lack of competitive advantage. Mark Cuban’s offer faced competition when Robert Herjavec made a higher equity demand of 48%, ultimately leading him to opt out. The founders hesitated on Mark’s initial offer but ultimately accepted the $250,000 for 25%, seeing value in Cuban’s tech background and his alignment with their desired valuation. The negotiation showcased the founders’ determination and the tough decisions they had to make to secure a deal that aligned with their goals and vision for Changed.