Beverage Boy Floating Beer Koozie

DEAL

EPISODE SUMMARY

🕓 Air Date: February 6, 2015

Asking For:

$50,000 for 15%

Investor:

Daymond John

Deal:

$50,000 for 35%

PRODUCT SUMMARY

BeverageBoy is a floating drink holder designed to prevent spills in pools. It provides a unique and entertaining way for people to enjoy drinks while floating in water.

WATCH HERE

IN A RUSH?

Click these to jump to the section you want to read.

Background Story

BeverageBoy, as presented on Shark Tank by founder Kevin Waltermire, is a product born out of a moment of leisure and inconvenience at a college pool party. Kevin, based in Orakei, Auckland showcased his innovative solution to a common problem faced by many who enjoy poolside relaxation. His entrepreneurial journey began when he observed a friend’s drink tumbling off a raft, prompting him to question why beverages lacked their own floating support.

The inspiration struck him during that college pool gathering, leading to the inception of BeverageBoy. Kevin’s background, beyond this brief introduction on the show, remains undisclosed. However, his ability to identify a common issue and provide a creative solution demonstrates a knack for innovation. In the pitch, Kevin conveyed the essence of his product with enthusiasm and humor, emphasizing how the BevBoy can turn an ordinary pool day into an extraordinary experience.

The product is not only functional but also promises to add an element of fun and uniqueness to poolside activities. The pitch showcased his passion and belief in the BevBoy’s potential to make a splash in the market. The founding story reflects an entrepreneurial spirit driven by a desire to solve a real-world problem in a novel and entertaining way. This background story adds a personal touch to the product, creating a narrative that resonates with the challenges and inspirations faced by many startup founders.

The Product

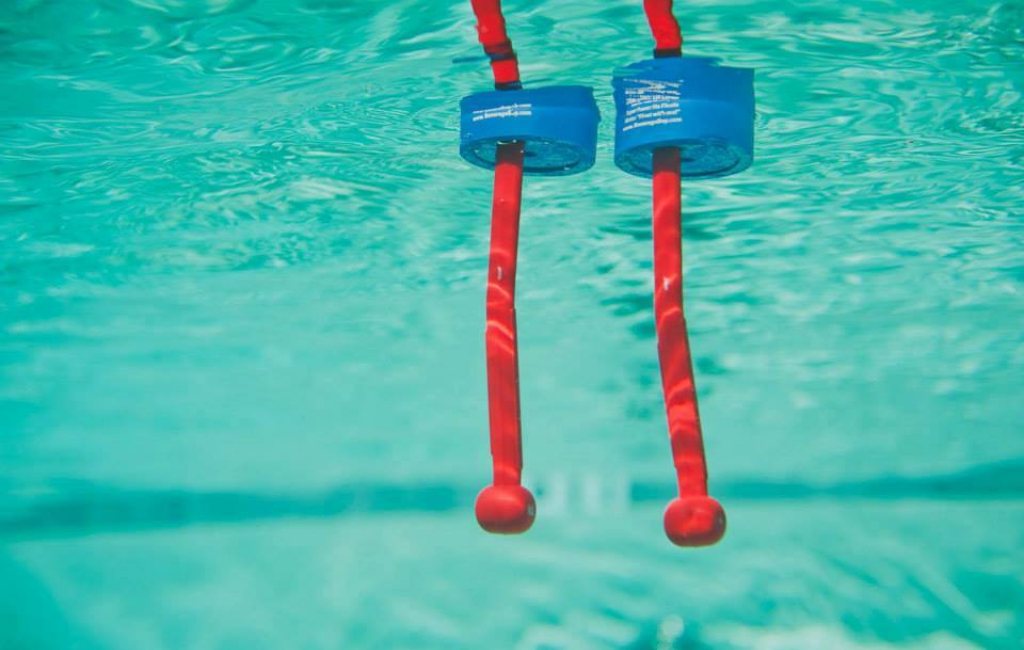

BeverageBoy, presented by founder Kevin Waltermire on Shark Tank, is a clever solution designed to enhance the poolside experience by preventing drink spills. The product consists of a floating drink holder with a unique weighted extension, providing it with a center of gravity.

This design ensures that, even in the presence of waves or movement, the BevBoy remains stable and prevents spills. The BevBoy offers users a hassle-free way to enjoy their favorite beverages while floating in a pool. Its buoyant construction makes it an ideal companion for pool parties, ensuring that drinks stay afloat and within easy reach.

Kevin wholesales the BevBoy at $5 and retails it for $9.99, making it an affordable and entertaining addition to poolside activities. The product’s affordability and functionality make it an attractive option for consumers seeking both practicality and enjoyment.

Kevin expressed his vision of the BevBoy being available in major retail chains such as Bed Bath & Beyond and Walmart. This suggests that the product may be accessible to a wide audience through various retail channels, offering customers the opportunity to easily incorporate the BevBoy into their poolside experiences at an affordable price point.

How It Went

The company’s position before Shark Tank

Kevin Waltermire provided insights into the performance of BeverageBoy. As of the pitch, the company demonstrated promising traction. Over the last six months, BeverageBoy generated $10,500 in revenue, with sales extending from Massachusetts to Texas. Kevin mentioned selling 2,500 units, indicating a relatively healthy demand for the product. The pitch primarily focused on showcasing the product’s potential and securing a deal with the Sharks. Partnerships and wholesale agreements were briefly touched upon.

Kevin mentioned that he wholesales the BevBoy at $5. While he didn’t delve into specific partnerships or wholesalers during the pitch, his mention of selling out at the promotional-products show in Chicago suggests an interest from potential retail partners. Kevin expressed interest in expanding the product’s presence to major retail chains like Bed Bath & Beyond and Walmart, indicating a strategic vision for growth. In terms of funding, the pitch revealed that Kevin was seeking a $50,000 investment for a 15% equity stake in the company.

Overall, the company appeared to be in a growth phase, with positive early sales figures and aspirations for expansion into larger retail markets. The deal with Daymond John marked a significant milestone in BeverageBoy’s journey, providing both capital and strategic support for future development and market penetration.

The Negotiations:

The negotiations for BeverageBoy unfolded with a lively exchange of banter and offers in the Shark Tank. Kevin Waltermire initially sought a $50,000 investment for a 15% equity stake in his company. The Sharks, known for their scrutinizing questions, raised concerns about the product’s market potential and its limited sales figures. Despite initial skepticism from Kevin O’Leary and Lori Greiner, the humorous pitch and the uniqueness of the BevBoy intrigued the Sharks.

Daymond John was the first to make an offer, proposing $50,000 for a 40% equity stake. This initial offer demonstrated Daymond’s belief in the product and his willingness to take on a significant portion of the business. Lori Greiner, known for her expertise in QVC and retail, entered the negotiation with an offer of $50,000 for a 30% equity stake. However, her offer came with a contingency – Kevin must secure a purchase order from a major retailer like Bed Bath & Beyond, Walmart, or Target.

The negotiation took an unexpected turn when Daymond John adjusted his offer, agreeing to the 35% equity stake that Kevin was seeking. This shift in equity percentage showcased Daymond’s flexibility and eagerness to secure the deal. In the end, Kevin accepted Daymond John’s offer of $50,000 for a 35% equity stake, marking the successful negotiation. The deal with Daymond John not only provided the desired capital but also brought a strategic partner on board who could potentially assist with the product’s growth and distribution.