Better Life Cleaning Products

DEAL

EPISODE SUMMARY

🕓 Air Date: November 1, 2013

Asking For:

$400,000 for 7%

Investor:

Lori Greiner

Deal:

$400,000 for 17% equity, dropping to 7% after loan repayment

PRODUCT SUMMARY

Better Life offers a unique line of natural and safe cleaning products that outperform chemical alternatives.

WATCH HERE

IN A RUSH?

Click these to jump to the section you want to read.

Background Story

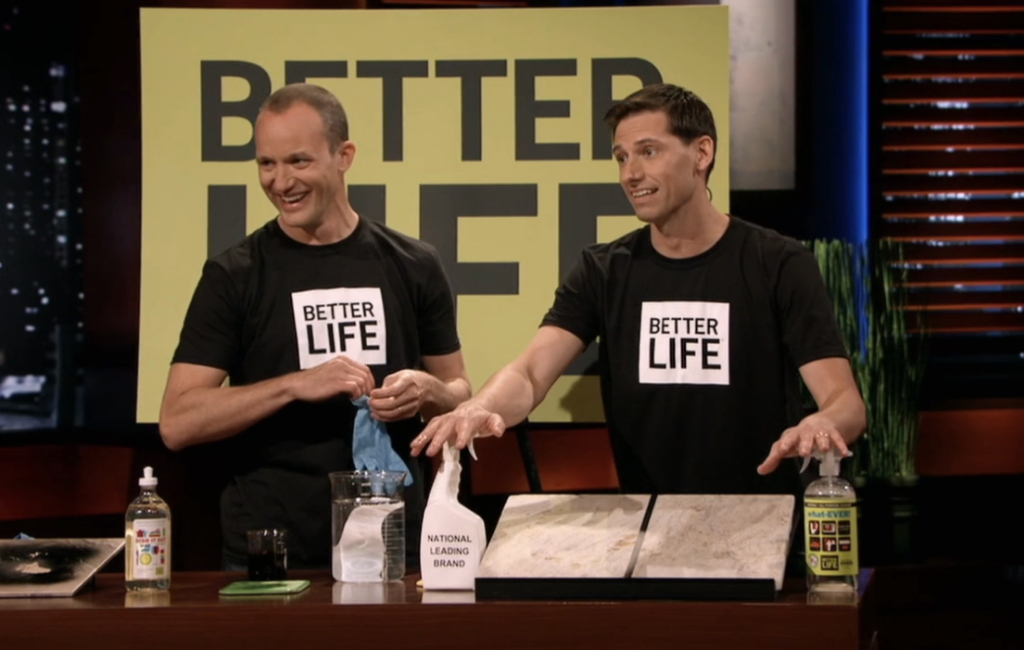

Better Life, headquartered in St. Louis, Missouri, was founded by best friends Kevin Tibbs and Tim Barklage. Their journey into the cleaning products industry began with a shared concern for the safety of traditional household cleaners, particularly with young children in their homes. Kevin, a formulation chemist by profession, possessed a deep understanding of chemical compositions and their potential health impacts. Tim, on the other hand, brought his entrepreneurial spirit and keen business acumen to the table.

The catalyst for their venture was their personal experiences as parents, witnessing their children crawling on floors and putting objects in their mouths. This sparked a determination to create cleaning products that were not only effective but also safe for both their families and the environment. Leveraging Kevin’s expertise, they embarked on a mission to develop a line of cleaning solutions using natural ingredients. Their vision for Better Life was born out of a desire to revolutionize the way people approached cleaning, shifting away from harsh chemicals towards eco-friendly alternatives.

Through extensive research and experimentation, they formulated products that surpassed the performance of conventional cleaners while eliminating harmful toxins and fumes. With a shared commitment to innovation and sustainability, Kevin and Tim launched Better Life over four years ago. Their dedication to quality and safety has since earned them recognition and success in the competitive cleaning products market, establishing Better Life as a trusted brand among consumers seeking safer, more environmentally conscious cleaning solutions.

The Product

Better Life offers a diverse range of cleaning products designed to meet various household needs while prioritizing safety and effectiveness. Their flagship products include a cream scrub and a multipurpose cleaner, both formulated with natural ingredients to deliver powerful cleaning without harsh chemicals.

The cream scrub is specially formulated to tackle tough stains, including soap scum and hard water deposits, without causing damage to surfaces. Its gentle yet effective formula makes it suitable for use on a wide range of surfaces, from countertops to tiles. Users simply apply the cream scrub, allow it to penetrate the stain, and then wipe away with a cloth or sponge, leaving surfaces clean and refreshed.

The multipurpose cleaner offers versatile cleaning power for everyday use, effectively removing dirt, grease, and grime from various surfaces throughout the home. Its plant-based formula is safe for use on countertops, appliances, floors, and more, making it a convenient all-in-one solution for household cleaning tasks.

Better Life products are available for purchase online through their website and through select retailers, including major chains like Whole Foods and regional grocery stores. Prices range from $5.99 to $6.99, offering consumers an affordable and eco-friendly alternative to traditional chemical cleaners.

How It Went

The company’s position before Shark Tank

Better Life has demonstrated solid performance and growth since its establishment. With sales totaling $2.1 million in the last 12 months, the company has established itself as a competitive player in the cleaning products market. Their success can be attributed to strategic partnerships with retailers such as Whole Foods, regional grocery chains, and home goods stores like Crate and Barrel. These partnerships have facilitated widespread distribution of Better Life products, reaching a diverse customer base seeking safe and eco-friendly cleaning solutions.

The company’s founders, Kevin Tibbs and Tim Barklage, have managed to maintain a financially healthy position, despite modest net profits of $115,000 pre-tax. Their focus on brand development and expansion has led to significant investments in marketing and product innovation, contributing to their steady growth trajectory. While profitability remains a challenge, Better Life continues to invest in building brand equity and expanding market reach.

In terms of funding, Better Life has relied on a combination of internal resources and strategic partnerships to fuel growth. Overall, Better Life is positioned for continued success in the cleaning products industry, driven by their commitment to quality, safety, and sustainability. With a strong foundation, loyal customer base, and strategic partnerships in place, the company is poised to capitalize on opportunities for growth and innovation in the years to come.

The Negotiations:

During the negotiations on Shark Tank, Better Life founders Kevin Tibbs and Tim Barklage faced a flurry of offers from the Sharks, each vying for a stake in their company. Lori Greiner, known as the “Queen of QVC,” initially offered $400,000 for 17% equity, providing access to retail giants like Bed Bath & Beyond and QVC. However, her offer was met with skepticism from other Sharks due to its high equity stake.

Kevin O’Leary presented a loan offer of $400,000 for 5% equity, which would revert to 7% after repayment. While attractive due to its low equity requirement, the loan structure raised concerns about the company’s profitability. Daymond John joined forces with John Paul DeJoria, offering $500,000 for 20% equity. This partnership promised both financial backing and industry expertise, with John Paul’s global distribution network adding significant value.

Mark Cuban proposed a higher investment of $800,000 for 20% equity, contingent on a partnership with Lori Greiner. However, concerns arose over the high valuation and lack of clarity on Greiner’s involvement. Ultimately, after careful consideration, the founders chose to accept Lori Greiner’s revised offer of $400,000 for 17% equity, recognizing the value of her retail connections and strategic guidance. This decision reflected their desire for a partner who could accelerate their growth while preserving a reasonable equity stake in their company.