Atlantic Candy Company

NO DEAL

EPISODE SUMMARY

🕓 Air Date: October 14, 2016

Asking For:

$1,000,000 for 10%

Investor:

No Deal

Deal:

No Deal

PRODUCT SUMMARY

Hollow chocolate articles with surprise toys inside, overcoming the U.S. ban on such products, providing a unique and exciting experience with over two billion units sold globally.

WATCH HERE

IN A RUSH?

Click these to jump to the section you want to read.

Background Story

Atlantic Candy Company, situated in St. Augustine, Florida, has a rich history rooted in the Whetstone family’s passion for chocolate. Jared Whetstone, a third-generation chocolatier, stands at the helm of this venture, carrying forward a legacy that began in the 1960s when his grandparents started selling chocolate and ice cream to tourists. Over the years, their small store evolved into a full-fledged chocolate factory, producing items for major players in the candy industry.

Jared’s father, a pivotal figure in the company, holds a significant contribution to the business. He not only continued the family tradition but also innovated by patenting a manufacturing technique for a popular candy product, one that had achieved global recognition but had not yet made its mark in the United States due to regulatory bans dating back to the 1930s. This challenge became a personal mission for Jared, witnessing firsthand the hard work his father invested in the business.

The core product, a hollow chocolate article with a surprise toy inside, became the focal point of Atlantic Candy Company’s pitch on “Shark Tank.” Jared, driven by the desire to see his father’s invention succeed in the U.S. market, took on the responsibility of presenting the product to the Sharks. Their patented capsule design, ensuring compliance with FDA regulations, allowed them to overcome historical safety concerns associated with embedding toys in chocolate.

The Product

Atlantic Candy Company’s flagship product is a unique and enticing creation: hollow chocolate articles that house surprise toys within. This innovative treat, designed to overcome historical bans on such products in the United States, provides consumers with an exciting and novel candy experience. The hollow chocolate shell, carefully crafted with the company’s patented capsule design, ensures compliance with FDA regulations.

This design innovation allows the chocolate and the enclosed toy to never actually touch, addressing safety concerns that led to the ban in the 1930s. The product’s appeal lies in the element of surprise, making each purchase akin to unwrapping a birthday gift. With over two billion of these globally popular items sold each year, the product has established itself as a beloved treat.

As Jared Whetstone showcased on “Shark Tank,” the candy comes in various flavors, adding an extra layer of delight to the consumer experience. In the episode, “Shark Tank” edition samples were provided to the Sharks, featuring a special collection of toy figurines representing the show’s cast. The product’s charm, coupled with its compliance with safety regulations, positions it as an attractive offering for consumers looking for a unique and enjoyable candy experience.

How It Went

The company’s position before Shark Tank

Atlantic Candy Company, at the time of their “Shark Tank” pitch, demonstrated a mixed performance and faced pivotal challenges. The company’s health and position reflected a history of success as contract manufacturers, producing complex chocolate articles for some of the industry’s biggest names. With a notable background in the candy industry, the company, based in St. Augustine, Florida, had established itself as a reliable partner in chocolate manufacturing.

The pitch revealed that the company’s primary partners included an Australian company, which licensed their patented capsule design for manufacturing these types of products in the U.S. This partnership, however, ended as the 10-year manufacturing agreement terminated on December 31st of the previous year. As for wholesalers, the company’s pitch did not provide specific details about current or past partnerships beyond the mention of the Australian licensee. However, it was disclosed that the company was previously engaged in contract manufacturing for other companies, showcasing their versatile capabilities in producing various chocolate items.

In terms of funding, the company sought $1 million on “Shark Tank” to fund its expansion and market entry strategy. The pitch did not provide specific details on the company’s profits and losses, available capital, or their current funding sources. The company’s structure was presented as having immediate production capacity of 18 million units a year, with plans to expand to over 100 million units annually by the following year. The structure also indicated ownership of a factory in St. Augustine, Florida, where machines were on order to accommodate the planned production increase.

The Negotiations:

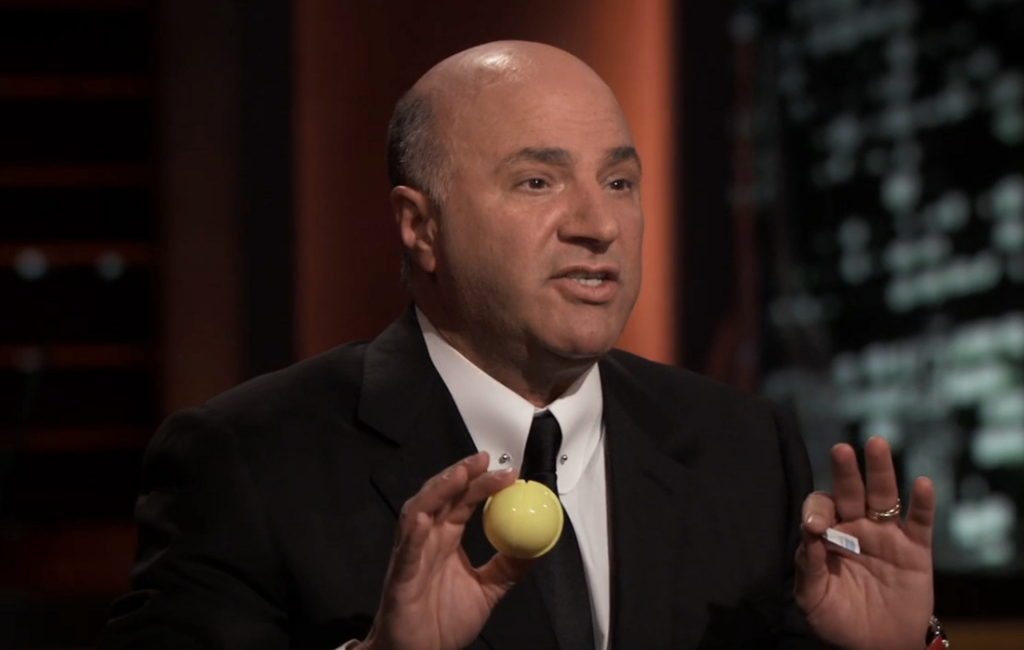

The negotiation process on “Shark Tank” for Atlantic Candy Company unfolded as a challenging journey, ultimately ending without a deal. Jared Whetstone, representing the company, sought $1 million in exchange for a 10% equity stake. The Sharks, however, had reservations and expressed concerns about various aspects of the business. Mark Cuban and Daymond John were the first to bow out, citing the challenges of the retail market and the company’s lack of experience in dealing with retailers. Lori Greiner and Kevin O’Leary expressed worries about the short timeframe, high valuation, and absence of an established distribution system.

Robert Herjavec raised concerns about the valuation given the existing risks and the impending expiration of the patent. Despite Jared’s attempts to convey the company’s potential and determination, the Sharks ultimately passed on the opportunity. They highlighted the competitive nature of the candy industry, the short timeframe due to the patent’s limited life, and the risks associated with building a retail infrastructure. The valuation, combined with uncertainties about the company’s ability to navigate the market, led each Shark to decline making an offer.

While the negotiations did not result in a deal, the Sharks encouraged and wished Jared luck in his endeavors. The experience served as a learning curve for Jared, who acknowledged the challenges but expressed gratitude for the opportunity to pitch his family’s business on a platform as significant as “Shark Tank.” Despite the setback, the Sharks acknowledged Jared’s resilience and determination in the face of adversity.