Wildwonder – Probiotic Drinks

DEAL

EPISODE SUMMARY

🕓 Air Date: January 13, 2023

Asking For:

$500,000 for 5%

Investor:

Tony Xu

Deal:

$500,000 for 6% + 3% advisory shares

PRODUCT SUMMARY

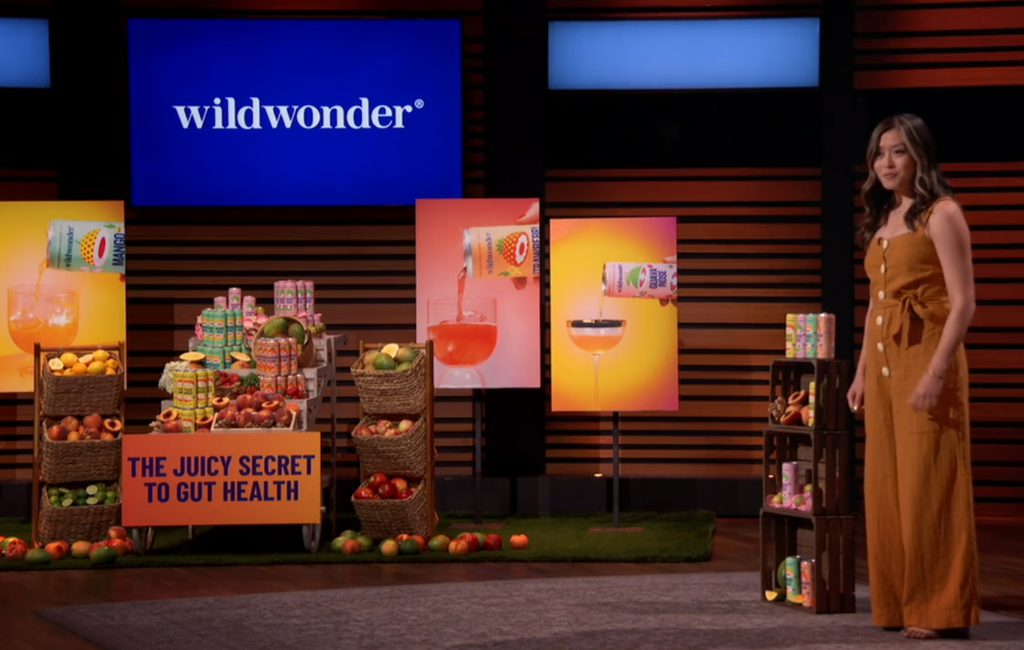

wildwonder is a sparkling drink that reimagines traditional healing tonics with gut-supporting superfoods, probiotics, and prebiotics, available in various flavors, providing a healthier alternative to soda and kombucha.

WATCH HERE

IN A RUSH?

Click these to jump to the section you want to read.

Background Story

The founder, Rosa, hails from China and was raised by her grandparents for the first 12 years of her life while her parents immigrated to the United States. Despite arriving in the U.S. with zero knowledge of the English language, Rosa quickly adapted and excelled, joining her high school’s debate team within three years and securing a finance internship at Goldman Sachs in New York while still in college. After gaining experience in private equity and venture investing, Rosa launched wildwonder in 2020.

Her inspiration came from her grandmother’s wisdom on using food as medicine, particularly brewing healing tonics with wild herbs and botanicals. As an adult working a stressful job, Rosa experienced the effects on her health and turned back to her grandmother’s homemade tonics for relief. These tonics inspired her to create wildwonder, a modern drink that combines herbal wisdom with delightful flavors. She believed that better gut health should be accessible and enjoyable, without compromising on taste.

The Product

wildwonder offers a unique beverage that prioritizes gut health and combines the benefits of probiotics and prebiotics. The drink is designed to provide consumers with a flavorful and healthy alternative to traditional sugary sodas.

One of the key selling points of wildwonder is its commitment to health and quality. The drinks have 50% less sugar than kombucha and contain no artificial ingredients.

wildwonder’s drinks are low in calories, with each can containing only 35 calories, making them a suitable option for those looking to maintain or lose weight. The products can be purchased through their website and are also available in over 100 stores, including regional Whole Foods locations.

With a commitment to clean, organic ingredients, they retail for $3.49 per can, with plans to reduce production costs over time to reach 70 cents per can.

How It Went

The company’s position before Shark Tank

In 2020, wildwonder faced significant challenges due to the COVID-19 pandemic, which wiped out the company’s entire revenue stream. Despite this setback, Rosa knocked on 200 grocery store doors and got her website up and running within three months. By the end of the first year, the company’s products were available in over 100 stores, including regional Whole Foods outlets.

As of the Shark Tank pitch, the company had generated over $1.4 million in revenue year-to-date, with a run rate of $2.5 million. Although they had achieved notable distribution, they were not yet net profitable, a common challenge in the food and beverage industry. The focus was on increasing gross margins to improve profitability.

wildwonder had raised a total of $2.1 million in funding in the previous year. They were in the process of securing additional investments at the time of the pitch. Their previous round was conducted at a pre-money SAFE (Simple Agreement for Future Equity) with a $6 million cap.

The Negotiations:

During the negotiations on Shark Tank, Rosa initially asked for $500,000 for a 5% equity stake in the company. Mark Cuban, Kevin O’Leary, and Barbara Corcoran expressed concerns about the valuation, given the challenges of scaling a beverage company.

Tony, the “shark” who ultimately struck a deal with Rosa, offered $500,000 for a 6% equity stake with an additional 3% in advisory shares, effectively giving him a 9% interest in the company. Rosa was concerned about the dilution of her equity but recognized the need for additional capital to scale the business. She countered with a proposal of $500,000 for 6%, which Tony accepted.

Rosa’s willingness to adjust the terms Tony’s belief in the product and Rosa’s potential played a significant role in sealing the deal. The negotiation concluded with Tony offering $500,000 for 6% equity and 3% advisory shares, providing Rosa with the financial support needed to take wildwonder to the next level and expand her distribution further.