My Therapy Journal

DEAL

EPISODE SUMMARY

🕓 Air Date: September 6, 2009

Asking For:

$80,000 for 20%

Investor:

Robert Herjavec, Kevin O'Leary (50/50)

Deal:

$80,000 for 51%

PRODUCT SUMMARY

My Therapy Journal is an online psychotherapeutic tool providing an affordable alternative to traditional therapy through secure journaling and progress tracking.

WATCH HERE

IN A RUSH?

Click these to jump to the section you want to read.

Background Story

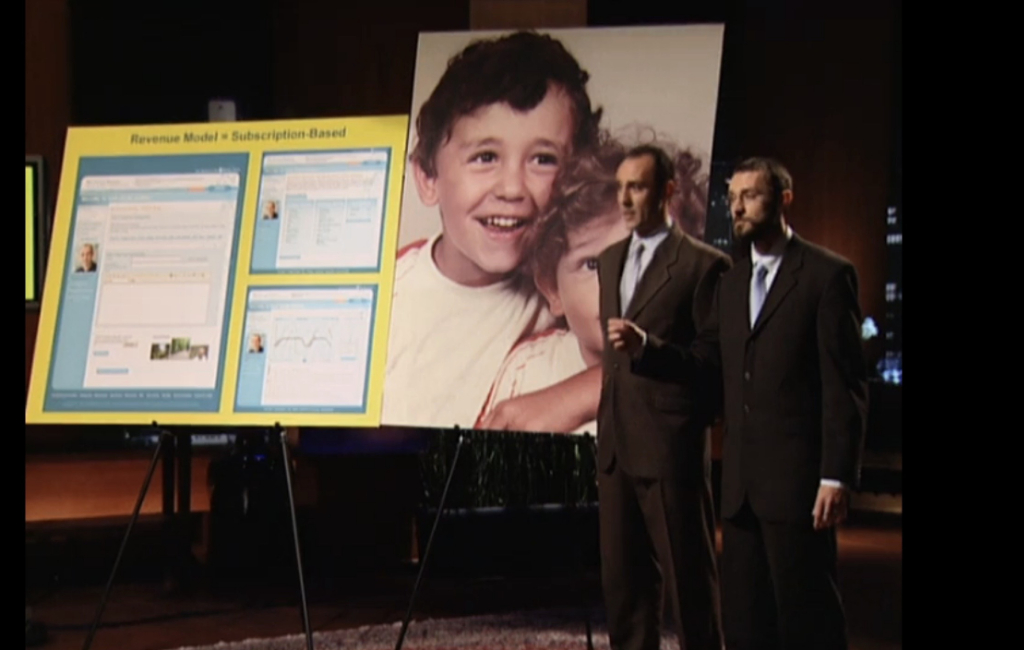

Rodolfo and Alexis Saccoman, originally from Brazil, relocated to the United States, driven by their father’s aspirations for their future. Their father, who began as a factory worker in Brazil and later pursued higher education, emphasized the importance of English proficiency and education for their success. Rodolfo established himself as a therapist with a private practice in San Francisco, while Alexis assumed the role of Director of Online Marketing for a prominent resort in Palm Beach, Florida.

Combining their diverse expertise in therapy and marketing, the brothers conceived My Therapy Journal, an innovative online platform aimed at revolutionizing mental health care. Inspired by their personal experiences and the challenges faced by individuals seeking therapy, they sought to create a solution that provided accessibility and affordability. Their shared vision was to leverage technology to offer therapeutic tools in a secure and convenient online format.

The concept for My Therapy Journal stemmed from Rodolfo’s insights as a therapist, recognizing the need for accessible mental health resources beyond traditional therapy sessions. Alexis’s background in online marketing provided the necessary skills to develop and promote the platform. Motivated by their upbringing and guided by their father’s lessons, the Saccoman brothers embarked on a journey to realize their version of the American dream while making a meaningful impact on mental health care.

The Product

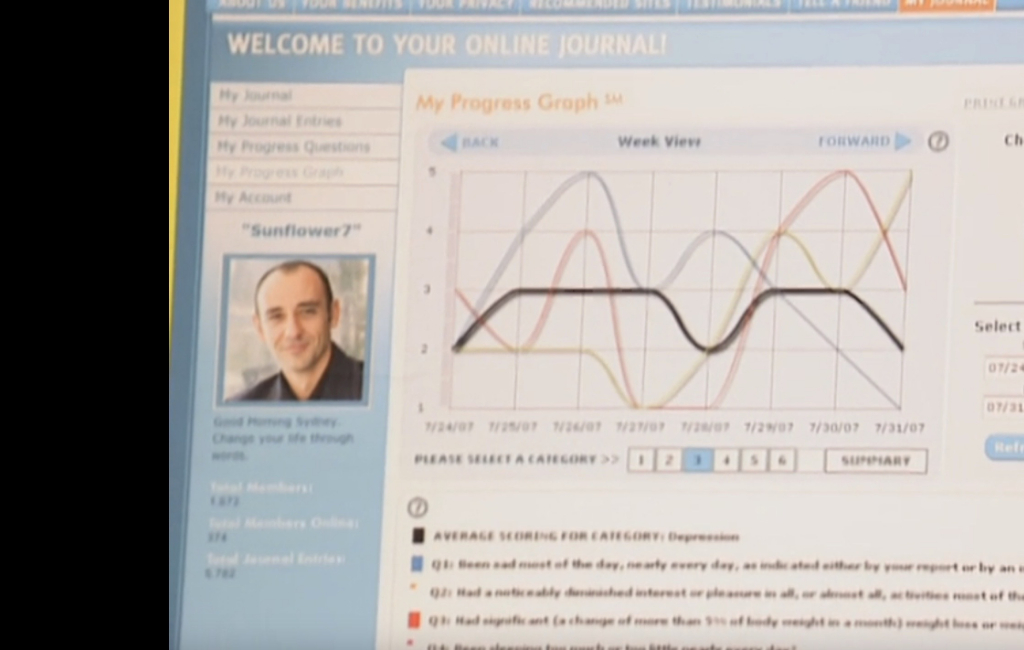

My Therapy Journal is an innovative online psychotherapeutic tool designed to provide users with a secure space to document their thoughts and track their mental health progress. The platform offers two primary components: journaling and progress tracking.

Users can utilize the journaling feature to express their emotions, thoughts, and experiences in a secure online journal. This provides individuals with a private outlet to explore their feelings and thoughts, similar to traditional therapy sessions. The platform ensures confidentiality and privacy, allowing users to freely express themselves without fear of judgment.

Additionally, My Therapy Journal includes a progress tracking tool that enables users to monitor various aspects of their mental health journey. Users can track emotions, behaviors, diagnoses, goals, and more, with the platform graphing this data over time. This feature allows users to visualize their progress and identify patterns or trends in their mental well-being.

The platform is accessible via subscription plans, offering flexibility for users to choose based on their needs. Pricing options include $7.95 per month for an annual subscription, $11.95 per month for a three-month plan, and $14.95 for a month-by-month option. By providing an affordable alternative to traditional therapy, My Therapy Journal aims to empower individuals to take control of their mental health and foster personal growth and self-awareness.

How It Went

The company’s position before Shark Tank

My Therapy Journal was in the early stages of development, with limited traction in terms of revenue and user base. The company had invested $125,000 of the founders’ savings into the platform, primarily focusing on software development. However, despite this investment, the company had only generated $4,000 in revenue the previous year. The platform had over 1,000 sign-ups, with approximately 121 paying customers after a 14-day free trial period. The website had attracted around 18,000 visitors, indicating potential interest but also highlighting the need for increased marketing efforts.

One significant opportunity for My Therapy Journal was its ongoing discussions with Aetna, a major insurance company with 37 million members. These discussions presented a potential partnership that could significantly scale the business and expand its user base. However, at the time of the pitch, no formal agreement had been reached. In terms of funding, the company had relied solely on the founders’ personal savings, indicating a bootstrap approach to development. They had not secured external investment or funding sources beyond their initial investment.

The company’s structure appeared to be straightforward, with Rodolfo and Alexis Saccoman serving as the founders and primary decision-makers. However, they were seeking investment and guidance from the Sharks to accelerate growth and capitalize on opportunities such as the potential partnership with Aetna. Overall, while My Therapy Journal showed promise with its innovative platform and potential partnership opportunities, it was still in the early stages of development and faced challenges in terms of generating revenue and expanding its user base.

The Negotiations:

During the negotiation phase on Shark Tank, the Saccoman brothers initially sought $80,000 for a 20% equity stake in My Therapy Journal. However, concerns arose among the Sharks regarding the company’s low revenue and user base. Kevin Harrington and Barbara Corcoran were the first to bow out due to these concerns. Robert Herjavec and Kevin O’Leary expressed interest in the potential partnership with Aetna, seeing it as a significant opportunity for growth. They offered $80,000 for a 51% equity stake, contingent on securing the Aetna deal.

Daymond John also made an offer of $120,000 for a 50% stake, but the Saccoman brothers ultimately declined due to his lack of expertise in the internet space. After some deliberation, Rodolfo and Alexis accepted Herjavec and O’Leary’s offer of $80,000 for 51% equity, valuing the Sharks’ expertise and potential for growth. This deal concluded with Herjavec and O’Leary acquiring majority control of the company, providing the Saccoman brothers with the funds and strategic support needed to advance their business.

Additionally, Daymond John decided to make a separate deal with the brothers, offering $120,000 for a 50% stake, but they declined, choosing to move forward with Herjavec and O’Leary’s offer. The negotiation showcased the importance of strategic partnerships and expertise in the success and growth of a business, ultimately leading to a mutually beneficial agreement for all parties involved.